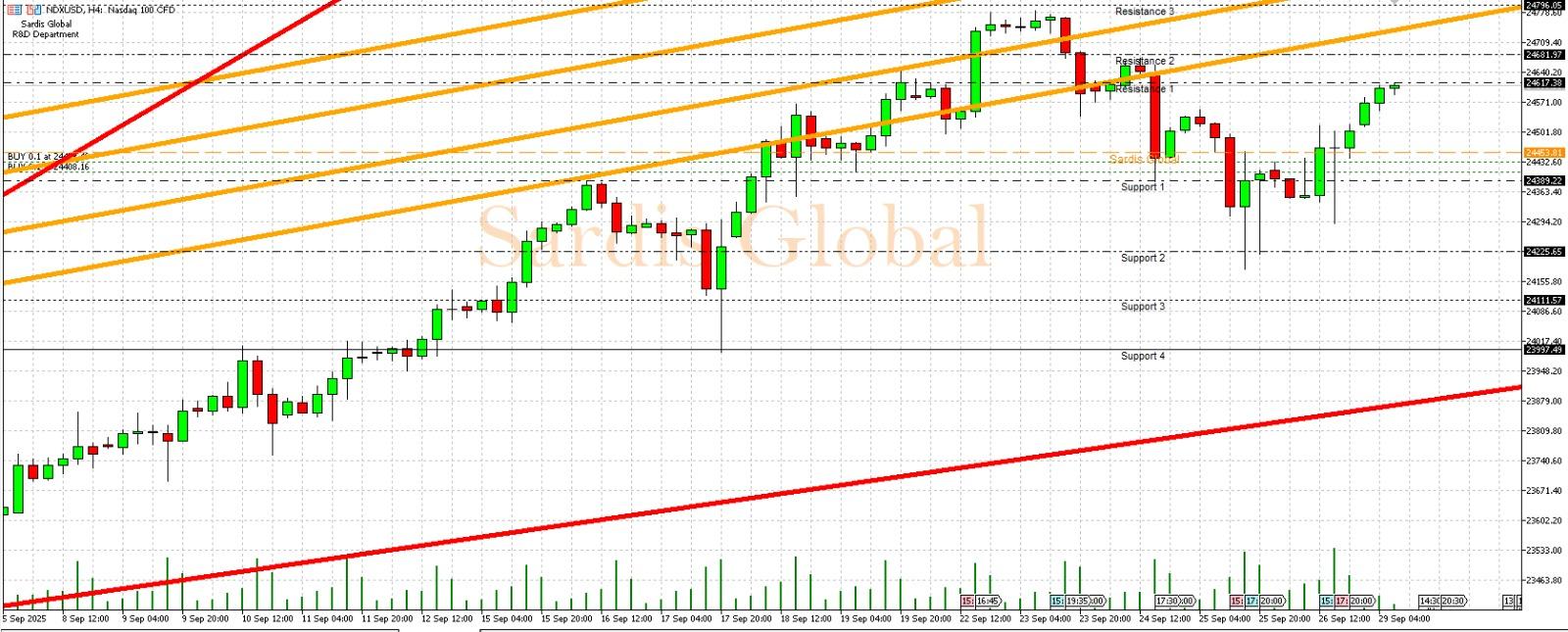

NDXUSD

The technology index Nasdaq 100 appears to have pulled back towards the pivot level of 24453, failing to break the resistance of 24681. This week, employment and confidence data, which will provide important signals about the health of the US economy, are crucial for the index. In particular, the Non-Farm Payroll and Unemployment Rate data to be announced on Friday, October 3rd, will be the main focus of the market. Although weaker-than-expected data could raise concerns about a slowdown in the economy, it may support interest-sensitive sectors like technology stocks by strengthening expectations for a Fed rate cut. In this case, the levels of 24617 (Resistance 1) and 24681 (Resistance 2) may be targeted. Conversely, strong employment data could maintain "hawkish" Fed expectations, putting pressure on the index and bringing the levels of 24389 (Support 1) and 24225 (Support 2) into focus. US President Trump's speech on Monday evening also has the potential to create volatility in the markets at the beginning of the week.