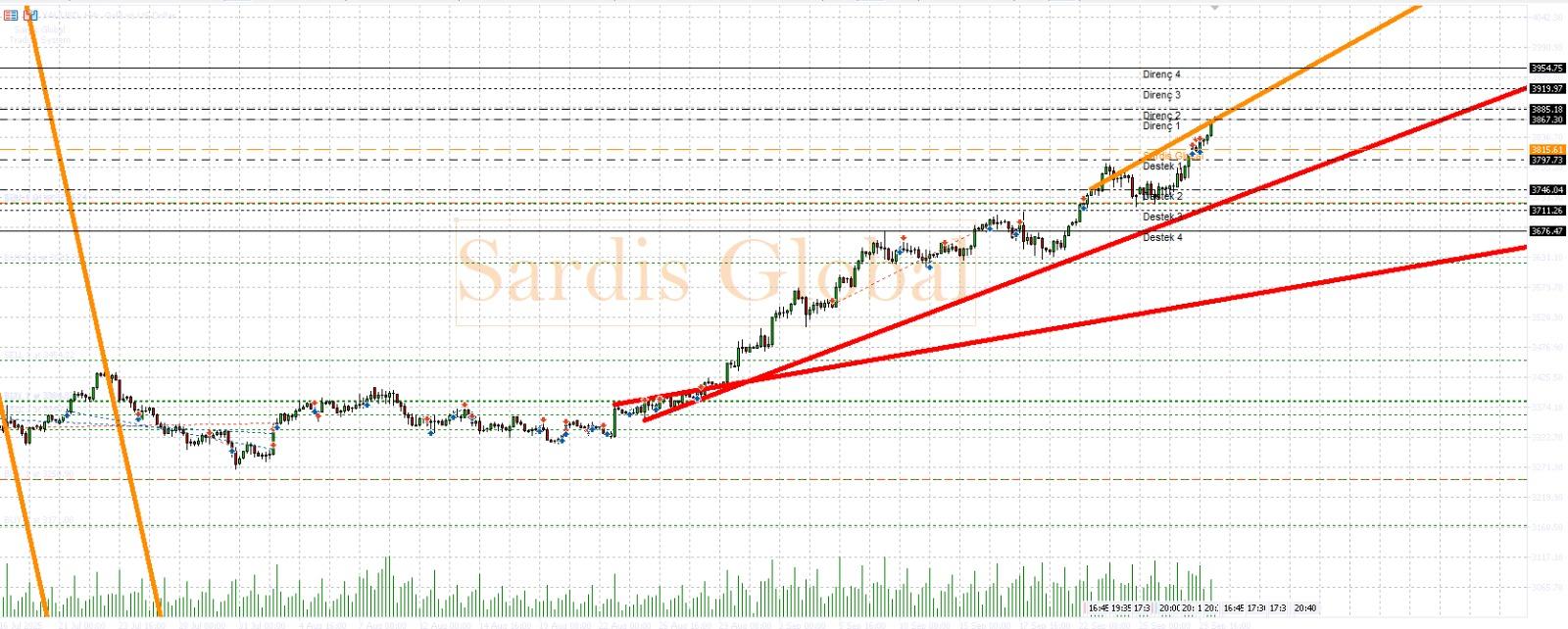

XAUUSD

Although gold is attempting to hold above the 3860 pivot level, it may experience a volatile trend throughout the week due to the heavy flow of data from the United States. The most critical day for gold will be Friday. If the US Non-Farm Payroll data to be released on October 3rd is significantly below the market expectation of 51K, the expectation that the Fed may cut interest rates will increase, leading to a weakening of the dollar. This situation could be a strong bullish trigger for gold and could quickly push the price to 3886 (Resistance 1) and then to 3909 (Resistance 2). However, a strong employment report that exceeds expectations would increase demand for the dollar, putting pressure on gold and bringing the levels of 3737 (Support 1) and 3711 (Support 2) into focus. Additionally, the CB Consumer Confidence data on September 30 and the ISM PMI data on October 1 will also have an impact on direction for the remainder of the week.