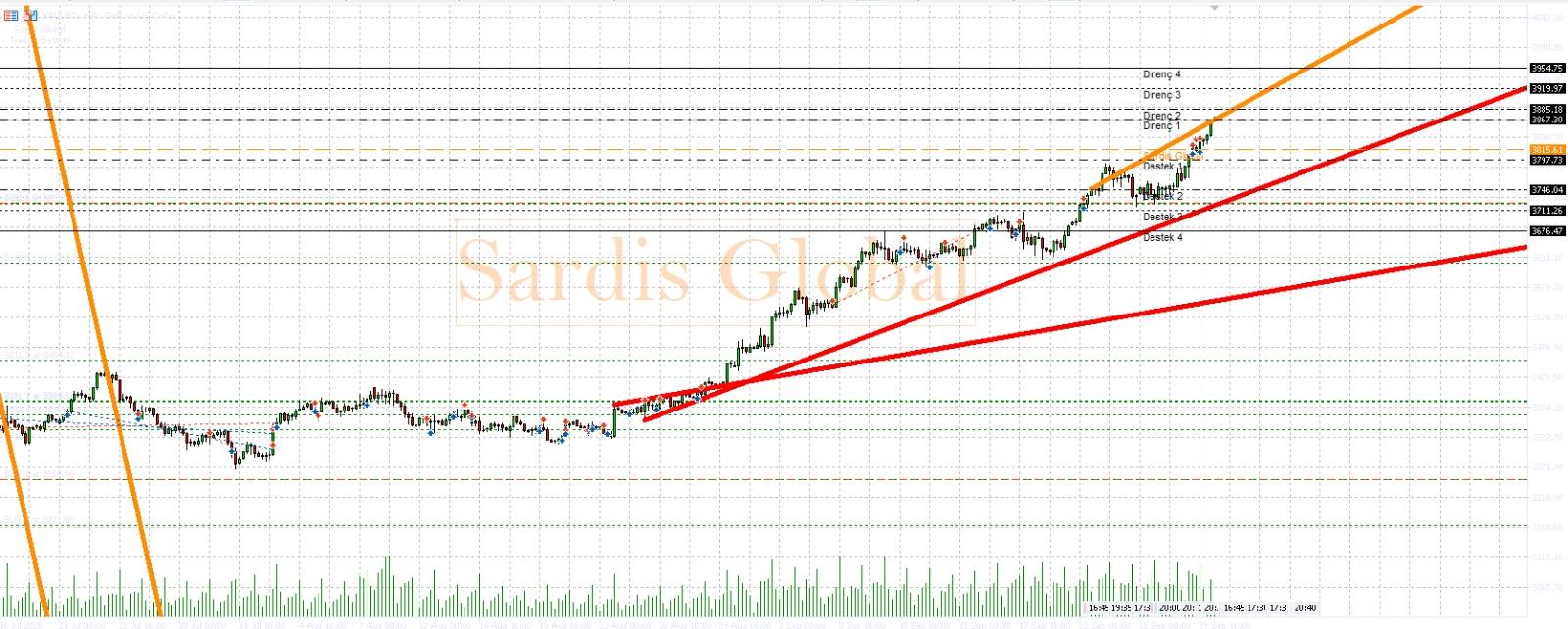

XAUUSD

While gold is fluctuating around the critical pivot level of $3,845, the market is focused on the U.S. Non-Farm Payroll data to be released on Friday. Ahead of this important data, today's ISM Manufacturing PMI figures could guide the market. Weak economic data that falls below expectations would weaken the dollar by reinforcing signs of a slowdown in the U.S. economy and the likelihood of a Fed rate cut, potentially triggering a strong buying wave for gold; in this scenario, resistance levels of 3,786 and 3,899 come into play. However, data that exceeds expectations could strengthen the dollar by keeping "hawkish" Fed expectations alive, creating pressure on gold and pulling prices towards support levels of 3,846 and 3,820.