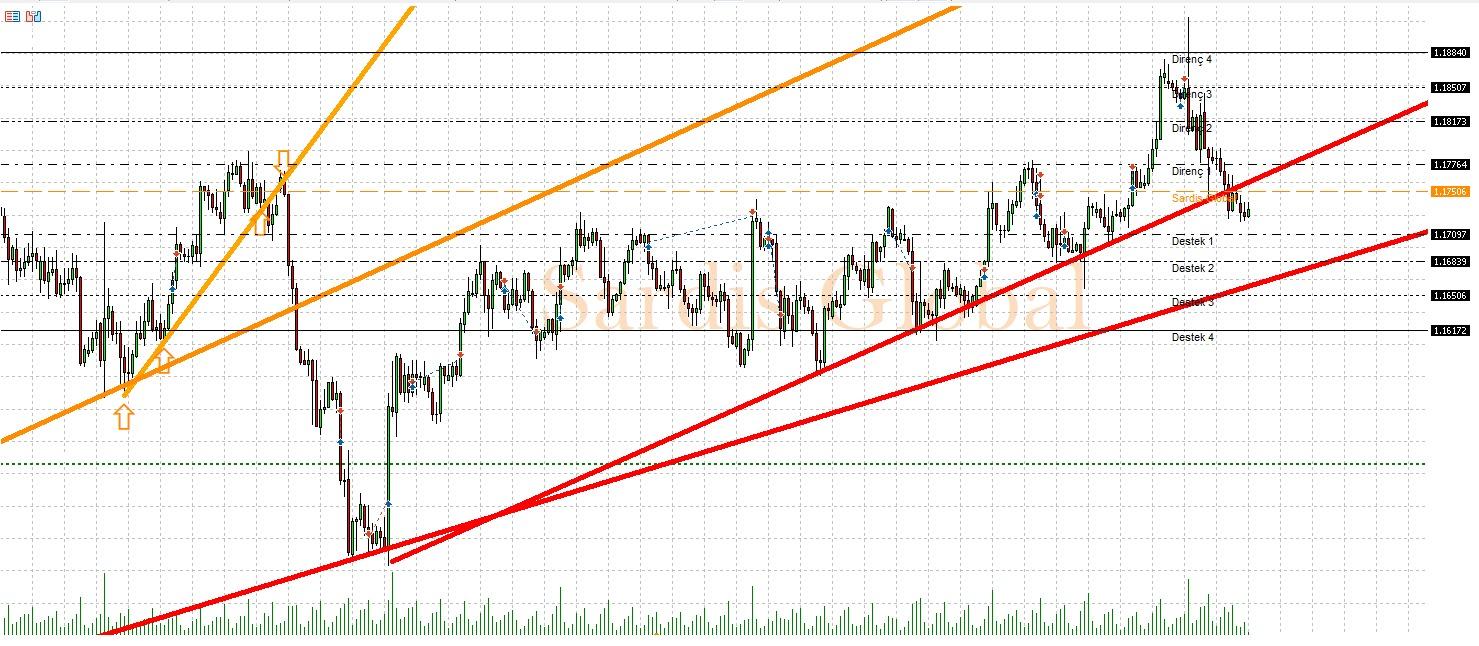

EURUSD

The EUR/USD pair starts the new week around the 1.17506 pivot level, with all eyes on the US PMI data to be released on Tuesday and Fed Chairman Powell's speech. PMI data falling below expectations and dovish messages from Powell could lead to a weakening of the Dollar, pushing the pair towards resistance levels of 1.17727, 1.17959, and 1.18173. However, strong upcoming data and Powell adopting a hawkish stance emphasizing inflation could create pressure on the pair, triggering a pullback towards support levels of 1.17264 and 1.17052. Throughout the week, Thursday's GDP and Friday's Core PCE inflation data will also increase volatility in the pair.