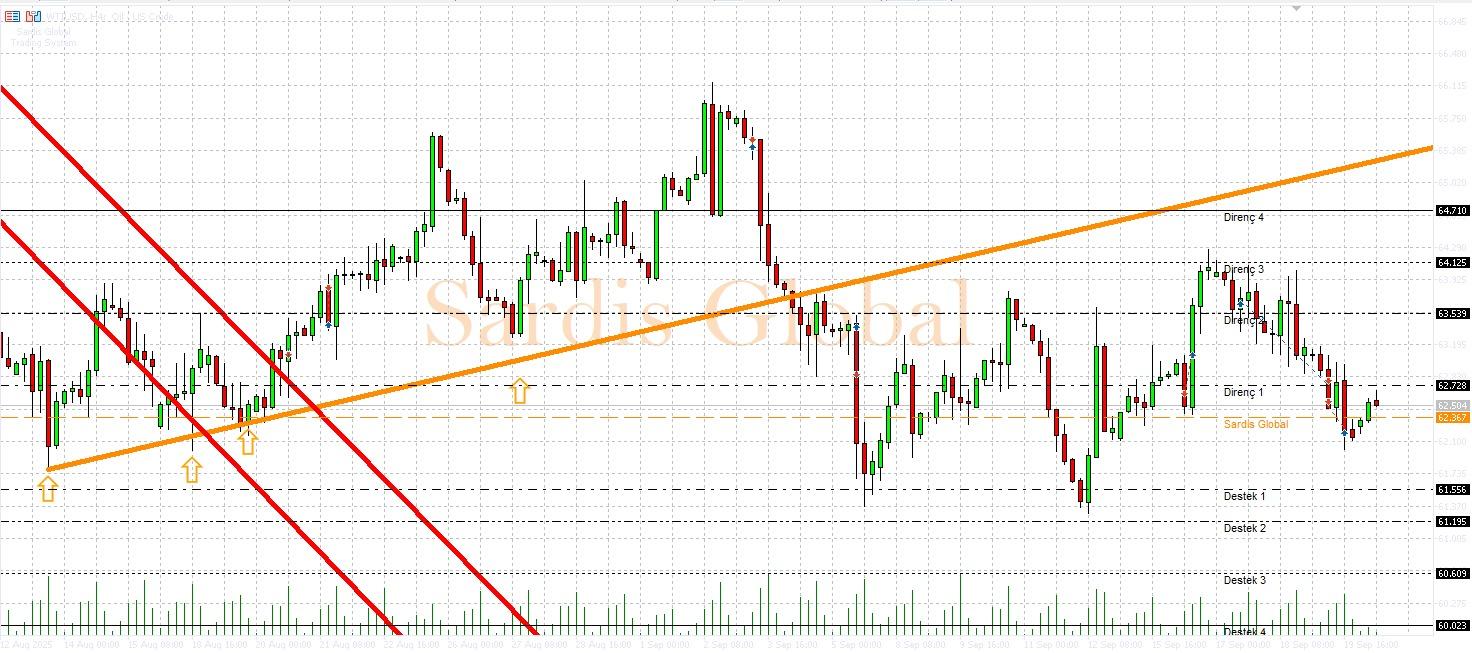

WTIUSD

WTI crude oil is starting the week just below the pivot level of 62.292, focusing on the economic signals coming from the US. The most decisive data for oil prices will be the Crude Oil Inventories report, which will be released on Wednesday. A significant decrease in inventories could strengthen the demand perception, pushing WTI to resistance levels of 63.111, 63.570, and 64.025. Additionally, positive signals regarding global growth from Powell's speech on Tuesday and GDP data on Thursday will support this rise. However, an unexpected increase in inventories or weak economic data could trigger demand concerns, pushing prices towards support levels of 61.558 and 61.195.